Introduction

The New Year is the perfect time to set fresh goals and take control of your financial future. One of the most effective ways to do this is by creating a clear, structured yearly budget. A solid financial plan can provide peace of mind, reduce stress, and set you on a path to achieving your long-term financial goals. However, taking the first step can feel overwhelming. That’s where professional advice comes in.

1. Reflect on the Past Year

Before looking forward, it’s important to look back. Take time to review your income, expenses, and savings habits from the past year. Ask yourself questions like:

- Did I meet my savings goals?

- Were there any unexpected expenses that caught me off guard?

- Where did most of my money go?

By reviewing past spending habits, you’ll gain a clear understanding of areas where you can make improvements. If you’re unsure how to interpret this information, a financial advisor at Finance One can offer insights and help you identify trends that may not be obvious.

2. Set Clear Financial Goals

A budget without a goal is like a journey without a destination. Setting clear financial goals will give you something to aim for. Your goals could include:

- Building an emergency fund

- Paying off debt

- Saving for a holiday, wedding, or big purchase

- Increasing retirement savings

3. Calculate Your Total Income

Knowing how much money you have coming in each month is essential to effective budgeting. Include all sources of income, such as:

- Your salary

- Additional income from side hustles

- Government benefits or grants

- Investment returns (where applicable)

A financial advisor can help you take a holistic view of your income streams, identifying opportunities to boost your earnings or manage fluctuations in variable income.

4. List Your Essential Expenses

Start by listing your non-negotiable expenses — the bills that must be paid each month, such as:

- Mortgage or rent payments

- Utilities (electricity, gas, water)

- Groceries

- Insurance premiums

- Loan repayments

5. Track Discretionary Spending

Discretionary spending includes non-essential expenses such as dining out, entertainment, and subscriptions. While it’s important to enjoy life’s little luxuries, it’s also crucial to know where your money is going.

A financial advisor can provide valuable insight here, offering suggestions on how to cut back on discretionary spending without sacrificing your quality of life.

6. Build a Savings Plan

Savings should be a key component of your yearly budget. Create a plan to set aside money each month towards your savings goals. Consider opening a separate savings account to keep your funds out of reach.

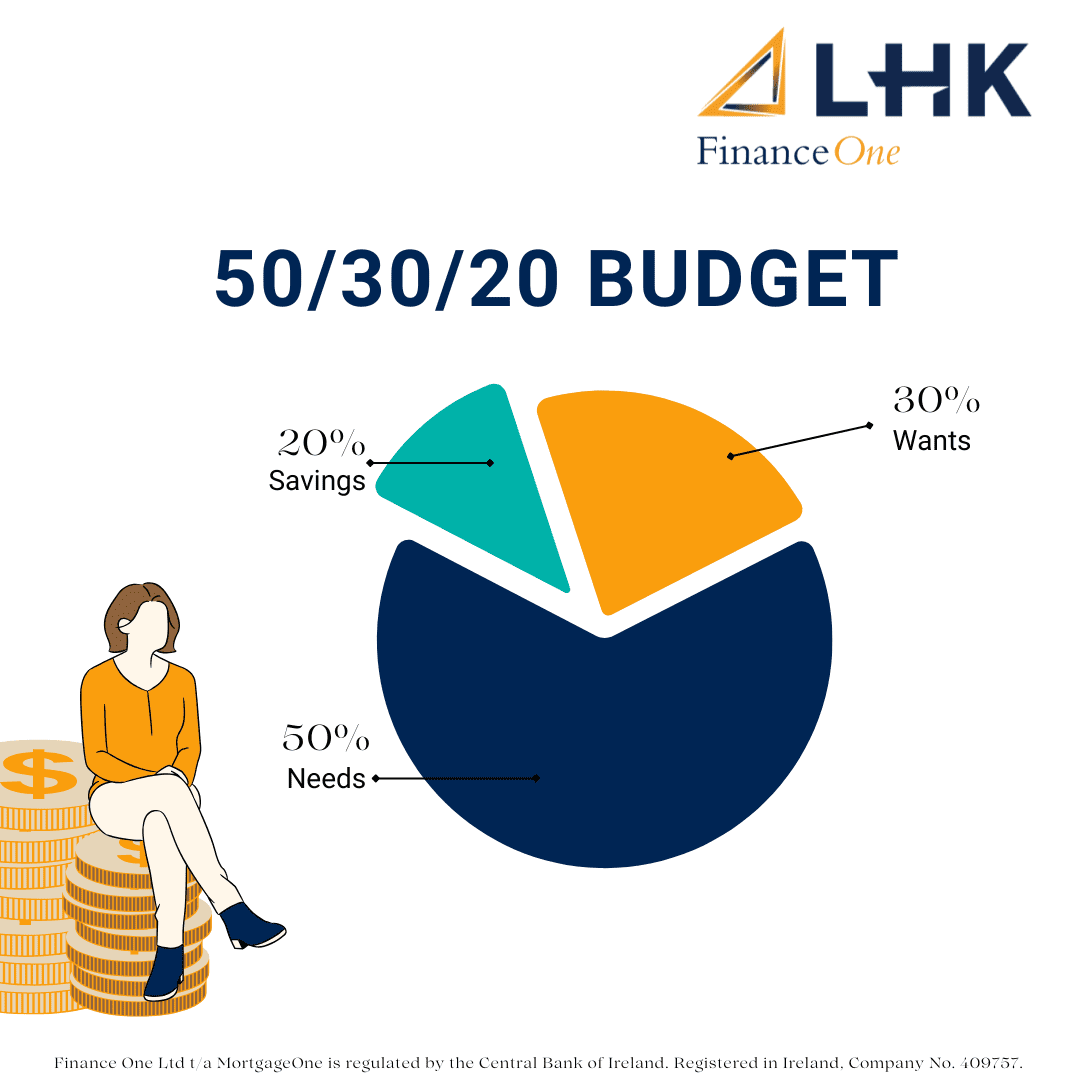

A financial planner can help you make the most of the 50/30/20 rule:

- 50% of your income for needs (essential expenses)

- 30% for wants (discretionary spending)

- 20% for savings and debt repayment

Working with a professional allows you to develop a tailored savings strategy, one that fits your lifestyle and future aspirations.

7. Plan for Irregular Expenses

Irregular expenses are the surprise costs that tend to pop up throughout the year. These could include car repairs, gifts for birthdays, or back-to-school expenses. To prepare for these, build an emergency fund and set aside a small amount each month for unforeseen costs.

8. Review and Adjust Regularly

A budget is not set in stone. Life changes, and your budget should too. Revisit your budget every few months to ensure it’s still aligned with your goals and circumstances. If your income increases, allocate more towards savings. If expenses rise, adjust accordingly.

With a financial advisor by your side, these reviews become more effective. They’ll ensure you’re adapting to changes and staying on track for your long-term goals.

9. Seek Professional Advice

If you’re feeling overwhelmed or unsure where to start, a financial advisor can provide personalised guidance. At Finance One, our financial planning experts are here to support you at every stage of your journey.

From setting clear financial goals to building a sustainable budget, we’ll work with you to create a plan tailored to your unique needs. Our advice is rooted in experience and designed to help you achieve financial freedom. When you work with a financial advisor, you’re not just getting a plan — you’re getting peace of mind.

Take Control of Your Finances Today

Creating a yearly budget isn’t just a nice idea — it’s a powerful step towards financial independence. By setting clear goals, tracking expenses, and making small adjustments throughout the year, you’ll feel more in control of your finances and better equipped to handle unexpected costs.

But you don’t have to do it alone. At Finance One, we’re passionate about helping people achieve their financial goals. If you’re ready to take control of your finances in the New Year, get in touch with our financial planning experts. Contact Finance One today to start your journey towards financial well-being and make this your best financial year yet.